Tons of CMMS applied by (heavy) equipment users based on Enterprise accounting and maintenance systems. In fact they are transactional systems. They focus on specific jobs and not the asset life cycle. Without a life cycle approach to asset management, value adding functions like first principles maintenance budgeting, strategy optimization, component risk analysis, long term resource planning, economic life optimization are not possible.

Tons of CMMS applied by (heavy) equipment users based on Enterprise accounting and maintenance systems. In fact they are transactional systems. They focus on specific jobs and not the asset life cycle. Without a life cycle approach to asset management, value adding functions like first principles maintenance budgeting, strategy optimization, component risk analysis, long term resource planning, economic life optimization are not possible.Several adds value to your existing enterprise system by providing a life cycle cost methodology around your assets.

Life Cycle Costing (LCC) predicts the total costs, resources, utilization and productivity for an asset over its entire life cycle. It is an excellent tool for assessing alternatives which has made it very common in the procurement of large assets.

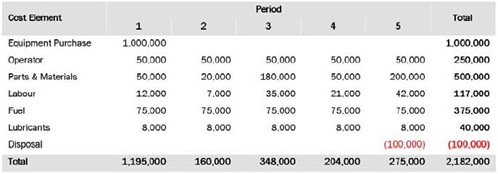

LCC also provides a rational framework to model equipment operation, taking account of all pertinent cash flows for the life of the machine. It allows management to take a holistic view of physical assets, considering the full impact of the operating environment. The LCC model can also be easily extended to evaluate not only the cost of operating equipment, but also the number and type of parts required as well as the hours of labor and expected equipment performance. A simple LCC cash flow model is shown below.

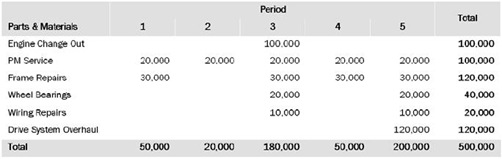

The total cost of owning and operating the equipment is the sum of the individual cost elements. Life cycle cost analysis is often referred to as a ‘first principles’ cost analysis tool. It involves understanding the detail of the individual cost elements and building these up to the ultimate life cycle cost. Each of the cost elements can then be broken down further. For example, the Equipment Purchase consists of the capital price, transport to site, commissioning and local options. The Parts & Materials elements are made up of the cost associated with all of the maintenance tasks required to keep the equipment operating at its design capacity.

For example, the Engine Change Out shown in the model above is scheduled to occur in period three. This is driven by an estimated life for the engine of 12,000 hours and an expected utilization of the equipment of 5,000 hours per year. If the estimated life of the engine, or the utilization of the equipment, changes, the model may provide a different result.

The benefits of this model for comparing like alternatives can be readily seen. If you also understand the productivity of the equipment, the analysis can quickly be used to compare different sizes of machines for the purposes of equipment selection and benchmarking.

Once built, the model can be easily extended to evaluate not only the cost of operating equipment, but also the number and type of parts required as well as the hours of labor and expected equipment performance.

0 comments:

Post a Comment